This chart explains how AI is rewiring society

All the money in the world is going to data centers and superintelligence.

I can’t stop thinking about this chart.

It captures how dramatically AI is rewiring both society and the economy.

For the first time ever spending on data center construction will eclipse investment in traditional office buildings this year, according to data cited in a New York Times report.

The two categories are roughly even today but by 2026 the gap is projected to widen sharply, reflecting the trillions of dollars being reallocated in the name of AI, super-intelligence and cloud computing.

That divergence highlights two structural changes:

The rise of physical spaces for robots: Data centers and high-tech factories will house the GPUs and hardware fueling exponential AI growth.

The decline of physical spaces for humans: Remote work has lasted well beyond the pandemic, and millions of people have made their home offices permanent.

No matter what you think of AI, this is the direction investors and corporations believe the world is heading. Digital-first productivity over a physical presence.

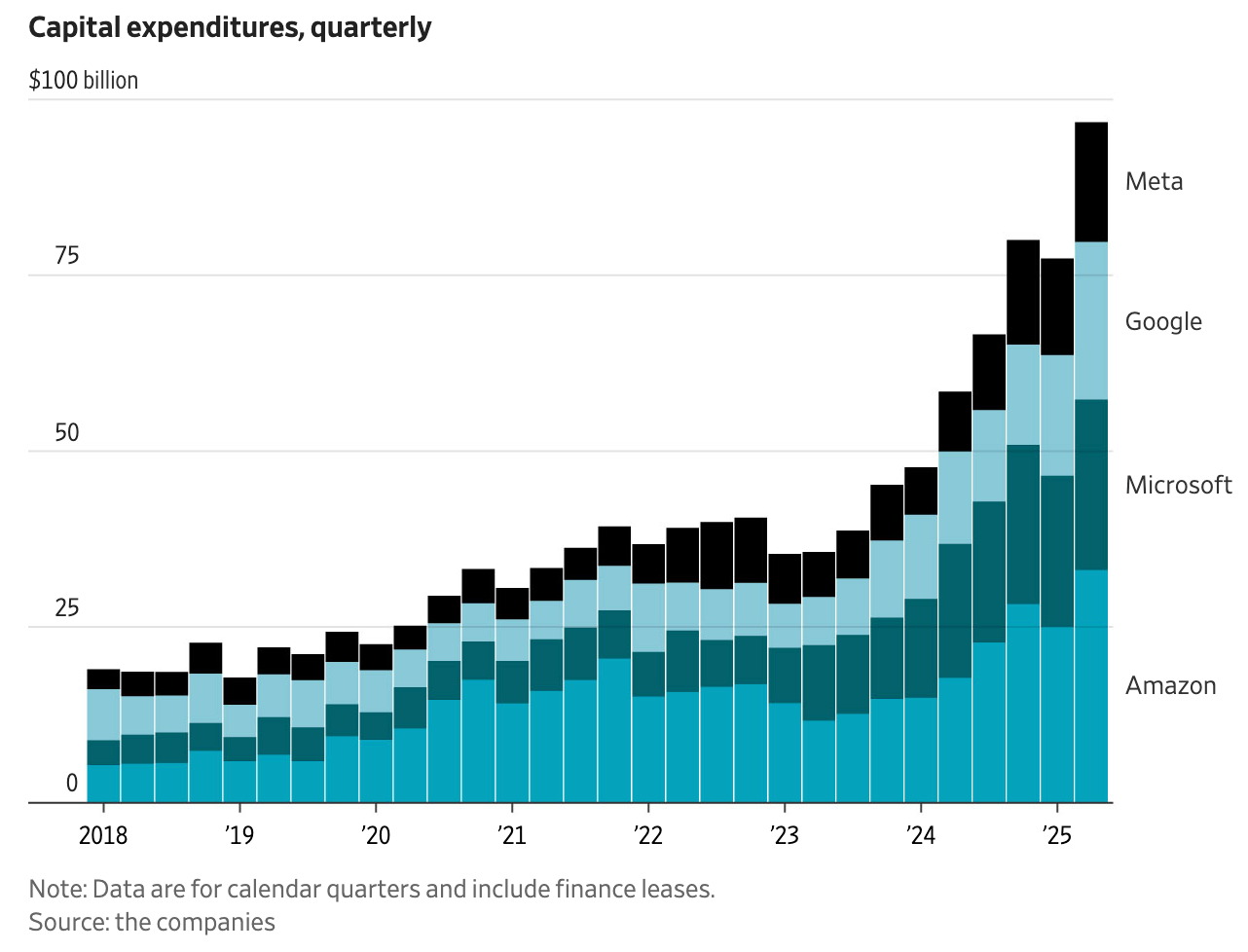

Capital flows tell the story. This second chart from The Wall Street Journal underscores the point.

Since ChatGPT’s debut in late 2022, four of the most consequential companies in the world — Meta, Google, Microsoft and Amazon — have nearly tripled their combined quarterly capital expenditures to $100 billion.

The trajectory runs nearly vertical.

I have no idea whether AI is closer to the internet bubble or Industrial Revolution. Smart people have conflicting views on this.

But in this moment, it’s clear that the dollars are moving extremely fast in a single direction.

Notably, few companies seem concerned about hedging their bets.

And according to Big Tech’s balance sheets, the spending won’t run dry anytime soon. No companies in history have had deeper moats or higher profits.

For context, Meta alone — the parent company to Facebook, Instagram and WhatsApp — sees over 3.4 billion actives users every single day(!).

Bubble or not, Meta isn’t going away.

Investor Paul Kedrosky says that spending on AI infrastructure, measured as a percentage of GDP, has already surpassed what was spent on telecom and internet infrastructure during the dot-com boom.

That’s not without consequence, as Kedrosky notes:

Northern Virginia loses hundreds of acres of land a year to data centers

One third of data centers are now next to housing, schools, playgrounds and churches

Some neighborhoods have been completely encircled by data centers

In other words, we’ve long crossed the Rubicon.

Local communities are being reshaped as rapidly as the global economy.

Even if we eventually realize that some portion of the AI promise proves overhyped, the infrastructure will already be in place. It isn’t easy to deconstruct all that concrete and steel.

To this day we have a glut of unused, outdated fiber optic cables running underground — relics of the dot-com era.

Internet companies in the 1990s built out these expensive networks as fast as possible because everyone — executives, investors, celebrities, the public — was convinced that nothing would be enough to meet bandwidth demand.

Something I’ve learned reporting on financial markets is that we are prone to overestimate innovation in the short run and underestimate it in the long run.

Anyone who says they know what part of the cycle we’re in today is lying to you or themselves.

That said, the concrete is being poured either way.

Phil Rosen

Co-founder & Editor-in-Chief, Opening Bell Daily

Thank you for reading. If you enjoyed this post, consider hitting the “like” button to help boost visibility. If the ideas resonated, I’d love to hear why — reply directly to this email or leave a comment below.