My weekend at Warren Buffett's last dance

Four days of private dinners, Berkshire Hathaway side events, and parties in Omaha.

This letter is repurposed from my reporting that first appeared in Opening Bell Daily.

OMAHA, Neb. — After 55 years, Warren Buffett announced he will step down as the chief executive of Berkshire Hathaway at the end of 2025 and let vice chairman Greg Abel take his place.

Upon breaking the news, Buffett received a lengthy standing ovation from a stadium audience that included Apple’s Tim Cook, Pershing Square’s Bill Ackman, and former presidential candidate Hillary Clinton.

Today I’m sharing observations from Omaha no one else has written about.

I’ve gathered my takeaways from four days on the ground — drawn from a dozen side events and mini conferences, and conversations with locals, shareholders and billionaires who made the pilgrimage to what turned out to be Buffett’s final meeting as CEO.

The town that Warren built

Omaha is a stronghold of quiet Berkshire shareholders disguised as a billionaire’s hometown.

Every single interaction I had with locals reinforced just how much Buffett enriches his fellow townspeople.

One retiree I met, who spent his career at a railroad company owned by Berkshire, has lived a couple blocks from Buffett’s house for two decades. He told me he’s held Berkshire stock longer than he’s had most of his neighbors.

Many of his friends are millionaires because of it.

He explained that Berkshire’s Class A shares — which hover around $800,000 — are so coveted that periodically Omaha residents will list their homes for sale not in dollars, but in Class A stock.

When I brought this up to an employee in a desserts store, she said she had never heard of this but it wouldn't surprise her because “Berkshire stock only goes up.”

Indeed, across the downtown area, four different employees working in a vintage clothing shop, cafe, ice cream parlor and hotel bar, respectively, told me that they each own Berkshire stock.

The only Omaha resident I met who did not own Berkshire stock was an Uber driver — a single mother of two.

She told me that while she isn’t invested in the stock market, she adores Buffett because her daughter attended college for free on a “Buffett scholarship.”

Another business owner told me he works in the same office building as Buffett. At one point several years ago, when severe tornadoes threatened Omaha, he sheltered in the basement of the building with Buffett, who cracked jokes the whole time.

Meanwhile, one woman who had her paintings on display in a pop-up art exhibit, told me she went to grade school with Buffett’s son, Howard, who is 70.

Berkshire’s thriving secondary market

Like any asset tied to scarcity, Berkshire merch has liquidity of its own.

This starts with the passes. Each shareholder gets multiple tickets to attend the annual meeting, which I’ve learned get flipped on an active secondary market.

In the weeks leading up to the main event, shareholders flood eBay with passes ranging from $30 to $200 each.

Later, once the exhibit center opens for shopping on Friday and Saturday and attendees buy exclusive and limited-quantity Berkshire items, people list them online the same day at an eight- to ten-fold markup.

Berkshire featured only one book for sale this year, 60 Years of Berkshire Hathaway. As I wrote Friday, I secured one of the 5,000 available copies by waiting in line for nearly an hour the first day.

Shortly after Buffett announced the books had sold out the next morning, I saw copies listed online for eight times the price I paid.

That pales in comparison to the increasingly popular Squishmallows of Buffett and the late Charlie Munger, which I’ve seen listed for as much as twelve times the purchase price.

What happens to the meeting post-Buffett?

Buffett at 94 remains a box office headliner.

Doors opened for Buffett’s Saturday Q&A at 7 AM but people began lining up the night before.

(I was able to get a decent seat inside the stadium by showing up just before 6 AM.)

Without Buffett at the helm, however, even long-time attendees aren’t sure they would make the trip to Omaha.

One shareholder I met who has been to over a dozen Berkshire meetings said he actually expects attendance next year to surpass 2025’s roughly 40,000 guests — a mix of devotees paying homage and newcomers who regret never seeing Buffett.

After that, though, he said he expects about a 30% drop-off.

The broad consensus seems to be that only the most serious investors will attend moving forward.

Many of those who have attended more than once have a network of relationships they can make plans with in Omaha — a feeling similar to the excitement and nostalgia kids feel returning to the same summer camp year after year.

In their view — one I agree with — the best part of the weekend is the side events and dynamic relationships, not the actual meeting inside the stadium.

This is hard to grasp without experiencing first-hand.

One private dinner I attended, for instance, put me at the same table as a real estate mogul, a former Treasury official, a family office investor who piloted his own plane to Omaha, and multiple money managers overseeing eye-watering dollar amounts.

We all had a great time, and part of that is knowing how hard it’d be to replicate the evening outside of this specific weekend in Omaha.

New attendees won’t feel the same draw. First-timers simply go to see Buffett.

That said, almost everyone at that dinner felt that this would be their last time ever in Nebraska.

Nonetheless, I’m convinced I’ll return in 2026.

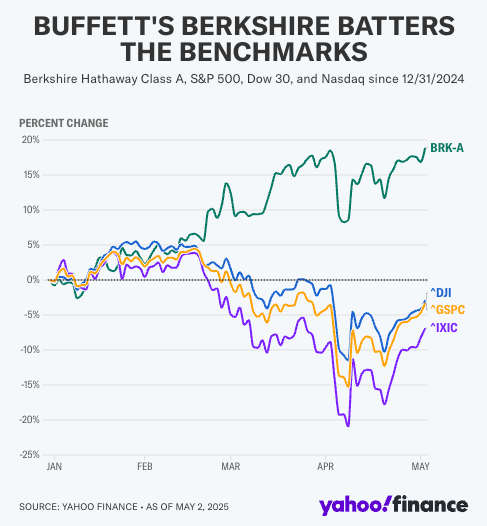

For what it’s worth, not one single shareholder I met expects Berkshire’s stock to decline, with or without Buffett.

Phil Rosen

Co-founder & Editor-in-Chief of Opening Bell Daily

A version of this post first appeared in Opening Bell Daily. Sign up here to receive my separate financial markets newsletter every morning.

From the archives:

What stuck with me reading this wasn’t the merch frenzy or Buffett’s celebrity status,it was how personal this whole machine has been for Omaha. You don’t see many Fortune 100 CEOs who live in the same modest house for decades and end up helping their neighbors become millionaires just by staying put and building slowly. That’s a weird kind of capitalism,not flashy, not algorithmic, just compound interest, stability, and a little trust.

But I get the sense this era is closing. You can’t replicate Buffett’s vibe with Greg Abel or anyone else. People didn’t fly to Omaha just for financial insights,they came for a ritual, a kind of Americana that’s disappearing. I wouldn’t be surprised if 2025 ends up being the peak attendance year, with everything after that feeling more like a trade show than a pilgrimage.

Still, part of me wants to go next year just to witness what the post-Buffett version looks like. Maybe it’ll be the last time it still feels like summer camp before it turns into Davos Midwest.

Love this!