Zooming out turns every doomsday into a footnote

The big picture provides the best antidote for short-termism, especially while investing.

If aliens wanted to learn about the human race and they could only study media headlines, here are some conclusions they would draw:

Every market dip is a crash

Every storm is the worst one yet

Every innovation is a threat

News outlets would give our extraterrestrial observers plenty of justification to conclude that Earth is in a permanent state of emergency. They’d assume humans are fragile, reckless and afraid — but just resilient enough to survive until the next day’s panic.

And yet the contradiction is obvious. How could a species so obsessed with documenting its own demise continue to function, let alone build rockets, write novels, and earn Michelin stars?

In a vacuum, every moment feels like catastrophe.

Zoom out and the story changes.

Over the last two trading days, the US stock market wiped out some $6.6 trillion in value after President Trump unveiled a sweeping tariff agenda. It was the worst stretch for American investors since the pandemic sell-off in 2020.

As a financial reporter, I’ve tracked every minute.

Whether you agree with the White House’s latest move or not, there is no denying its disruption.

I’ve spoken with sources working inside big banks and boutique investment firms who describe anxious clients, nuked retirement accounts and their own personal jitters boiling over.

These conversations reminded me that even professionals — the ones with access to data and granular details — are not immune to trepidation.

As long-time readers will know, I’m an optimist by nature. It’s hard to shake even when I’m tasked with reporting on oblivion.

While I write about in-the-moment nuances of a meltdown, I do my best to remind myself of the big picture.

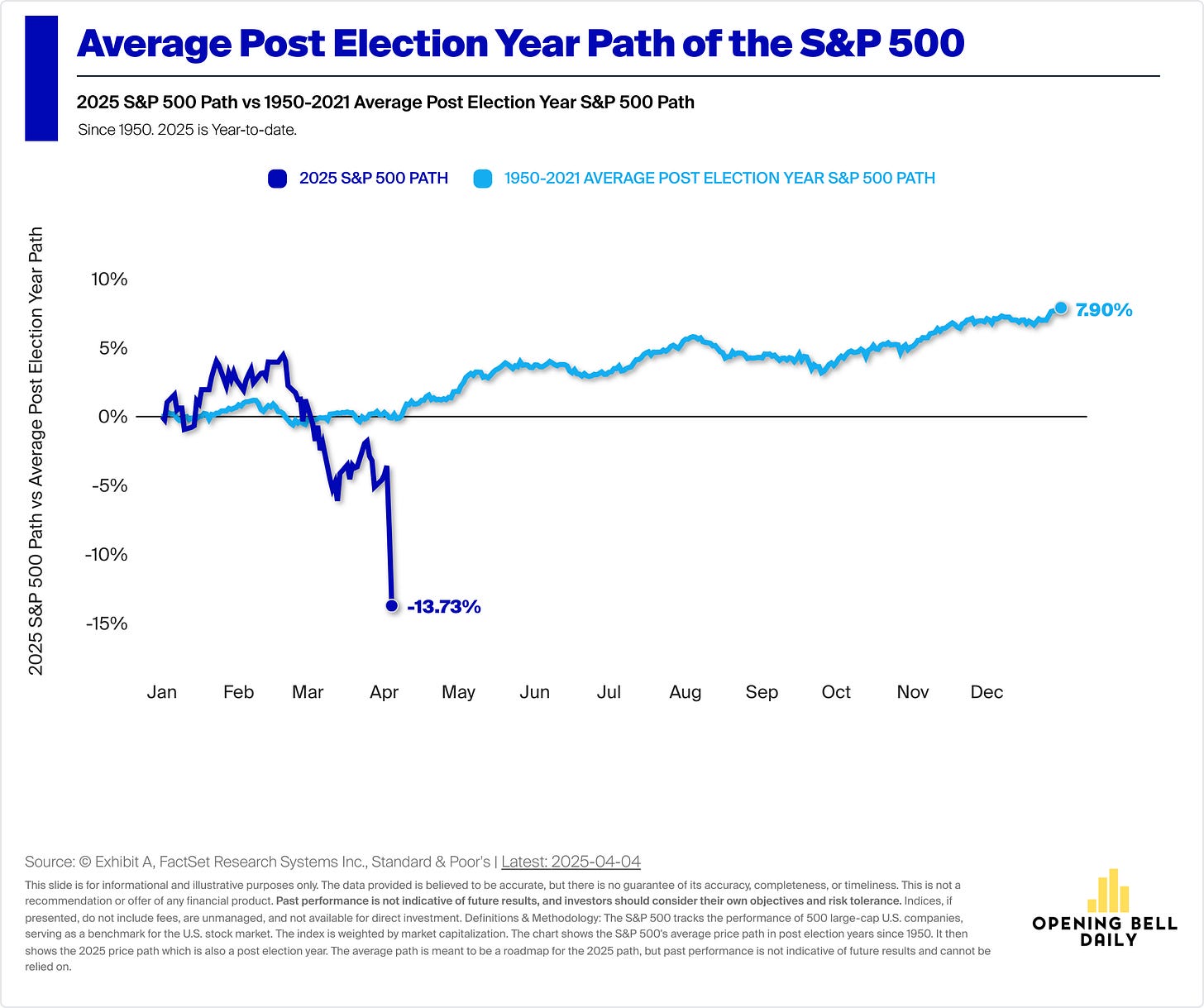

Here’s one chart that does not look so reassuring. The benchmark S&P 500 index is down nearly 14% to start 2025 — well below the average 8% gain seen the year after an election.

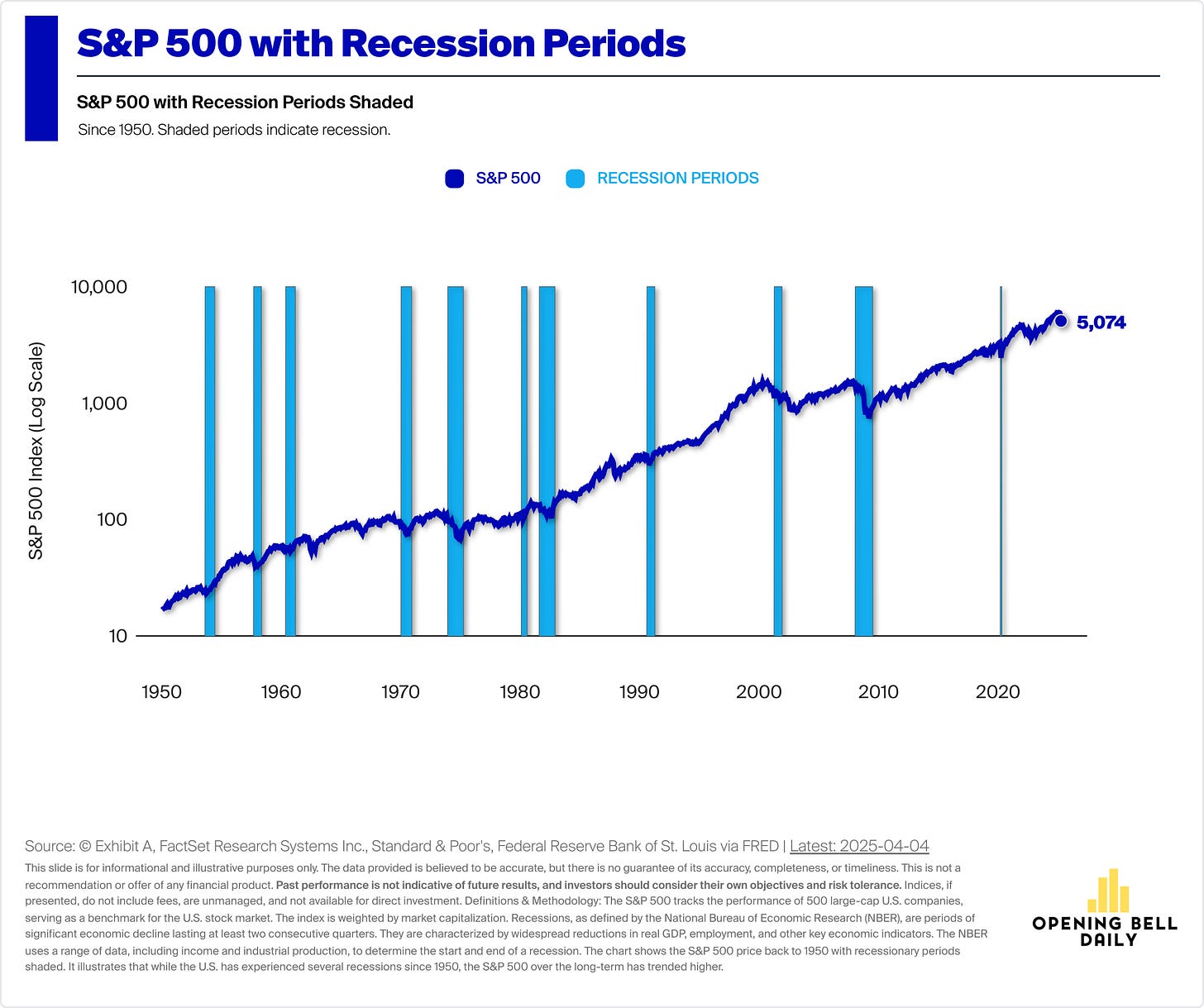

But zoom out and the shape of history returns. None of the 11 major US recessions since 1950 meaningfully derailed the stock market.

Even the bursting of the internet bubble and the housing crash barely register.

Friends have reached out this week asking whether it’s time to sell everything because of tariffs.

To be clear, nothing I write is financial advice, and I am not a financial advisor. But I will share that I personally have not sold anything. I’ve encouraged friends to stay put.

That view has nothing to do with the president or trade policy.

Consider two simple data points.

First, inflation is eating everyone’s money. A dollar today buys less than it did yesterday — and a hell of a lot less than four decades ago.

Look at what happened to $10 since 1983.

The second point is same as the first but flipped.

A single dollar investing in the boring S&P 500 in 1950 is now worth over $300.

On this chart, too, it’s hard to pinpoint recessions or market crashes.

Compounding has a way of smoothing over even the worst moments in history. That curve is the closest thing we have to proof that long-term optimism is rational.

If aliens stuck around long enough, I’d hope they’d realize that a very small subset of humans write headlines, and that humanity is actually shaped by quiet decisions made over decades.

If they asked for the secret to our prosperity, I’d show them a compound interest curve and call it “hope.”

Because to zoom out is to remember that progress rarely makes the front page.

Fear is loud. Growth whispers.

The surprising thing about us and our world isn’t that things fall apart. It’s that we manage to rebuild over and over with creativity and enthusiasm.

That’s the story of the charts.

You just have to step back far enough to see it.

Phil Rosen

Co-founder & Editor-in-Chief, Opening Bell Daily